One of my first honest articles was about the Rule of 72 (more Einstein Finance). The Rule of 72 is a simple heuristic for figuring out when your money can double in value, given a specific (compounding) growth rate.

Let’s make sure we are clear: the model I am working from assumes:

- I am putting an amount into a savings vehicle and not adding any more (so the model is flawed already, but stay with me on this)

- The rate of return stays the same throughout the period (again, flawed)

When I say doubling, based on those assumptions, it means the initial investment is now worth twice what it was.

I attempted to clarify my initial post with a very grainy-looking graph in Einstein: The Rule of 72 a few years later, but I think we can do better than that now.

First, a simple table following the formula:

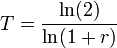

Where T is the number of periods and r is the interest rate compounded in that period, and the ln() function is the Natural Log (mascot of the University of Waterloo MathSoc).

| Rate (r) | Period to Double (T) in years |

| 0.50% | 139.0 |

| 1.00% | 69.7 |

| 1.50% | 46.6 |

| 2.00% | 35.0 |

| 2.50% | 28.1 |

| 3.00% | 23.4 |

| 3.50% | 20.1 |

| 4.00% | 17.7 |

| 4.50% | 15.7 |

| 5.00% | 14.2 |

| 5.50% | 12.9 |

| 6.00% | 11.9 |

| 6.50% | 11.0 |

| 7.00% | 10.2 |

| 7.50% | 9.6 |

| 8.00% | 9.0 |

| 8.50% | 8.5 |

| 9.00% | 8.0 |

| 9.50% | 7.6 |

| 10.00% | 7.3 |

| 10.50% | 6.9 |

| 11.00% | 6.6 |

| 11.50% | 6.4 |

| 12.00% | 6.1 |

| 12.50% | 5.9 |

| 13.00% | 5.7 |

| 13.50% | 5.5 |

| 14.00% | 5.3 |

| 14.50% | 5.1 |

| 15.00% | 5.0 |

Simple calculation. You can see that it doesn't take long to go from taking 135 years to double your investment to 15 years to double your investment (0.5% to 4.5%), but it is easier to see in a graph how this all works:

This is a straightforward model, given that very few folks dump a load of money into a single investment and let it grow with no intervention. Still, it is worthwhile to understand that when someone talks about getting a 4.0% growth on their investment, that means their investment will double in 18 years (or so). It is a handy model to remember.

Einstein and Finance

Really? You think those two go together? I think so.

I remember when I first learned the rule of 72. It was comparable to my fascination of ants. Seriously, a colony of ants is quite amazing. Did you know they even build a landfill for all of their waste? Those little guys are quite intriguing…

The last time I was in the MathSoc office at University of Waterloo (and that was a looong time ago) the Natural Log was gone, replaced by an empty box of Tide, with a sign that said something like “Natural Log, recycled”.

The office has moved I believe as well. I was a Computer Science Club member, so we looked across the hall at MathSoc a great deal. The CSC was the cooler place to be, I always thought.

Very clear! Thanks for facilitating my financial education.

So if I take my current investment portfolio and say I’m earning 8%, it will double in 9 years. Now I need to check if I’m getting that rate of growth. I’m still contributing also.

The rule of 72 is great tool for dividend growth stocks I find cause of the real returns of dividends. Great recap !!!